Your paycheck stub isn't a fair record of the cash you've earned — it's an effective apparatus for pay optimization.

In this comprehensive guide, we'll investigate shrewd techniques that use the data found in your paycheck stub to assist you in making educated monetary choices and maximizing your profit.

From understanding conclusions to revealing covered- up benefits, let's dive into the world of paycheck stubs and find how they can be your key to money-related strengthening.

Sometime recently, we jumped into the techniques; let's decode the fundamental components of your paycheck stub. This report, given with each paycheck, is more than fair a receipt of your profit. It contains significant data that can help you oversee your accounts successfully.

Your net wage is the sum you've earned recently, any derivations. This incorporates your compensation or hourly wage, rewards, and other pay sources.

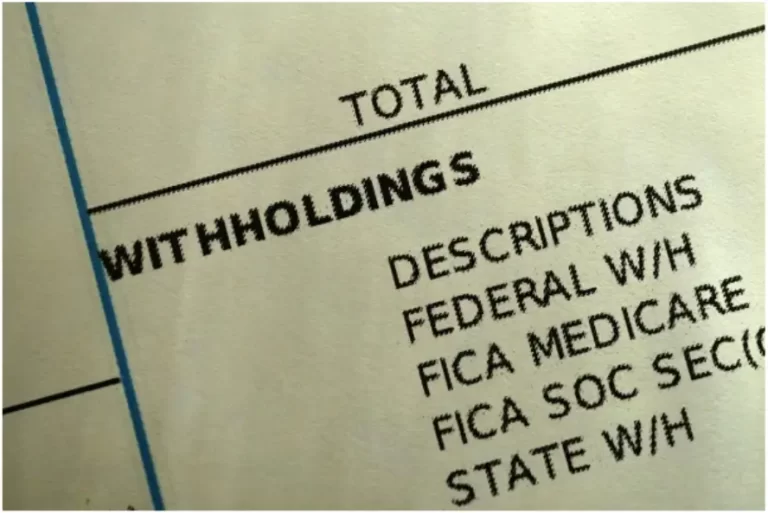

Findings are the sums subtracted from your net wage to calculate your net pay. This incorporates charges, retirement commitments, well-being and well-being protection premiums, and other withholdings.

Net pay is the sum you take domestically after all conclusions. It's the genuine cash you get and what you should base your budget on.

Your paycheck stub will detail the charges withheld, such as government wage charges, state wage assessments, and Social Security and Medicare commitments.

Look at your paycheck stub to clearly understand the derivations being taken from your net pay. This incorporates charges, retirement commitments, and well-being protection premiums. Knowing where your cash is going permits you to evaluate your money-related needs and make necessary alterations.

If your manager offers a retirement investment funds arrangement, take full advantage of it. Your paycheck stub will appear as the sum contributed to your retirement finance. Consider expanding this commitment if conceivable, remarkably if your manager matches contributions—this is free cash that can boost your long-term budgetary security.

Check your paycheck stub for well-being protection premium conclusions. If your employer offers multiple well-being plans, guarantee you've chosen the one that best fits your needs. If you have the alternative to contribute to a Wellbeing Health Savings Account (HSA) or a Flexible Spending Account (FSA), assess whether these may advantage you in terms of charge points of interest and covering qualified therapeutic costs.

Your paycheck stub gives knowledge of the taxes withheld from your salary. If you reliably get a noteworthy assess discount, you'll need to alter your assess withholdings to extend your take-home pay throughout the year. On the other hand, if you owe charges after the year, consider changing your withholdings to dodge punishments.

If you work overtime or get rewards as often as possible, keep a close eye on how these profits are reflected on your paycheck stub. Get the tax collection and any findings related to these additional salary sources. This mindfulness will assist you in arranging for godsends and dodging shocks come the assessment season.

Numerous paycheck stubs incorporate data on collected and utilized PTO. Frequently checking these equalizations guarantees you're mindful of your accessible time off and can arrange it appropriately. A few managers may permit you to cash out unused PTO or carry it over into another year, giving extra adaptability and money-related benefits.

In expansion to your customary earnings and findings, your paycheck stub might hold clues to extra advantages given by your manager. These might incorporate:

Scrutinize your paycheck stub for any boss matches, or commitments to your retirement arrangement. A few managers offer coordinating duties up to a specific rate of compensation. Taking full advantage of this advantage boosts your long-term investment funds.

Check for any derivations related to representative help programs, which may give private counseling, wellness programs, or other profitable assets. Taking advantage of these programs can contribute to your general well-being.

Your paycheck stub is more than fair a budgetary record—it's a guide to pay optimization. Understanding this archive's subtle elements, you'll take proactive steps to improve your money-related well-being. From maximizing retirement commitments to altering charge withholdings, each component of your paycheck stub offers meaningful experiences into your by and sizeable budgetary picture.

Engage yourself with information, and let your paycheck stub be an apparatus for not only following profit but also optimizing your salary and accomplishing your money-related objectives. Reveal covered-up advantages, make educated choices, and let your paycheck stub clear the way to monetary victory.

This post was published on January 10, 2024 2:20 PM

Digital literacy exceeds competitive advantages because it is an essential factor for economic preservation while… Read More

https://www.youtube.com/watch?v=wm6MXs3O5WE Subscribe to My Youtube Channel Secret Trick to Earn $250 Daily with CPA Marketing… Read More

https://www.youtube.com/watch?v=JqN6DRaPFYs In this Wix dropshipping tutorial, you will learn how to create a dropshipping website… Read More

To make good money from CPA marketing, Expert's Secret strategies are required to perform well… Read More

Are you looking to turn your website into a revenue-generating asset without the hassle of… Read More

Are you looking for a way to earn money online just by sharing links? or… Read More

This website uses cookies.

Leave a Comment